Explore web search results related to this domain and discover relevant information.

When authorization is required for the release of personal property, it is usually referred to as an estate tax waiver or a consent to transfer. New York State does not require waivers for estates of anyone who died on or after February 1, 2000.

After all processing is complete, the New York State Tax Department will provide a closing letter to certify that no tax is due or to serve as a final receipt for the tax due. The estate must keep this for its records.Learn how the Marriage Equality Act applies to taxes we administer. · For estate tax matters, executors must use Form ET-14, Estate Tax Power of Attorney, to give one or more individuals the authority to obligate, bind, or appear on their behalf before the department.For estates of decedents dying on or after January 1, 2019, and before January 16, 2019, there is no addback of taxable gifts.The Tax Law requires a New York qualified terminable interest property (QTIP) election be made directly on a New York estate tax return for decedents dying on or after April 1, 2019.

The Economic Growth and Tax Relief Reconciliation Act of 2001, phased out the state death tax credit over a four (4) year period beginning January 2002. Effective January 1, 2005, the state death tax credit has been eliminated. The information below summarizes the filing requirements for Estate, ...

The Economic Growth and Tax Relief Reconciliation Act of 2001, phased out the state death tax credit over a four (4) year period beginning January 2002. Effective January 1, 2005, the state death tax credit has been eliminated. The information below summarizes the filing requirements for Estate, Inheritance, and/or Gift Tax:For decedents that die on or after June 8, 1982, and before January 1, 2005, a California Estate Tax Return is required to be filed with the State Controller's Office if a federal estate tax return (Form 706) is being filed with the Internal Revenue Service.The California Generation-Skipping Transfer tax shall not apply to the generation-skipping transfers after December 31, 2004. ... The Declaration Concerning Residence form for decedents who had property located in California but were not California residents · Interest Rates Applicable for Underpaid California Estate Tax and Overpaid California Estate TaxThe State Controller's Office, Tax Administration Section, administers the Estate Tax, Inheritance Tax, and Gift Tax programs for the State of California.

The GOP tax law would further weaken an estate tax that has been slowly whittled away over the last several decades.

Congressional Republicans are proposing to permanently allow wealthy families to pass on more of their assets tax-free, as the federal government all but abandons taxing large inheritances. Under current law, estates pay tax only on transfers above $13.99 million for single filers and $27.98 million for married couples.Though they represent a small part of the overall costs of Trump’s tax bill, these changes are set to weaken an estate tax that already affects fewer households than it has in decades. When the federal estate tax was first imposed in 1934, roughly 8,600 deaths resulted in estate tax liability, or 0.9 percent of adult deaths.For 2025, only the portion of an estate above $13.99 million per person — a limit that also absorbs any large gifts made while someone is alive — is subject to the federal estate tax, and only the value over the exemption is taxed, at rates that top out at 40 percent.Senate Majority Leader John Thune (R-South Dakota), who has sponsored Senate legislation to outright repeal what Republicans call “the death tax,” has said doing so is necessary to prevent cash-poor firms, including family farms, from selling off equipment or land to pay the tax. The estate tax changes in the current GOP tax bill will cost the federal government roughly $210 billion over the next 10 years, according to the nonpartisan Joint Committee on Taxation.

When property is transferred at ... payment are made. Under present law, the estate of a decedent who, at death, owns assets in excess of the estate tax exemption amount—or $13.61 million in 2024—must file a Federal estate tax return....

Although amended many times, the estate tax, the gift tax (imposed upon transfers before a person's death), and the generation-skipping transfer tax have never directly affected a large percentage of taxpayers, as many fall below the exemption amount. Under the current Federal estate tax system, individuals can transfer up to a specified amount in money and other property without incurring Federal estate tax liability.When property is transferred at death, it is generally the responsibility of the estate to pay any taxes due as a result of the transfer unless other arrangements for payment are made. Under present law, the estate of a decedent who, at death, owns assets in excess of the estate tax exemption amount—or $13.61 million in 2024—must file a Federal estate tax return.However, only those returns that have a taxable estate above the exempt amount after deductions for expenses, debts, and bequests to a surviving spouse or charity are subject to tax at the highest maximum tax rate of 40 percent (see the table below on exemption amounts and tax rates).Over the years, some targeted provisions have been enacted to reduce the estate tax owed by farms and small business owners. These include a special provision allowing farm real estate to be valued at farm-use value rather than at fair-market value and an installment payment provision.

The IRS may impose estate taxes when a person dies while owning property. Estate taxes are only owed when the net taxable estate exceeds the descendent’s unified credit balance–which everyone is entitled to. If someone in your family dies while owning property, here's what you need to know ...

The IRS may impose estate taxes when a person dies while owning property. Estate taxes are only owed when the net taxable estate exceeds the descendent’s unified credit balance–which everyone is entitled to. If someone in your family dies while owning property, here's what you need to know about estate taxes and what your responsibilities are as a beneficiary.Written by a TurboTax Expert • Reviewed by a TurboTax CPAUpdated for Tax Year 2024 • August 2, 2025 4:32 AM ... The IRS may impose estate taxes when a person dies while owning property. Estate taxes are only owed when the net taxable estate exceeds the descendent’s unified credit balance–which everyone is entitled to.The One Big Beautiful Bill that passed includes permanently extending tax cuts from the Tax Cuts and Jobs Act, including increasing the cap on the amount of state and local or sales tax and property tax (SALT) that you can deduct, makes cuts to energy credits passed under the Inflation Reduction Act, makes changes to taxes on tips and overtime for certain workers, reforms Medicaid, increases the Debt ceiling, and reforms Pell Grants and student loans. Updates to this article are in process. Check our One Big Beautiful Bill article for more information. ... Estate tax is a tax imposed by the federal government on the value of property owned by a person at the time of their death.The gross estate includes the fair market value of all property the family member owned or had an interest in at the time of death, plus any life insurance and annuity proceeds, and in some cases, the value of property owned but transferred within three years before the person’s death. The tax law provides deductions to reduce the gross estate value, including funeral expenses, payments to pay outstanding debt, the value of the property intended for donation after death, any state death taxes, and the value of property transferred to a surviving spouse.

The U.S. Federal Estate Tax Unified Credit (the "Credit"), which allowed individuals to leave up to $13,990,000 to their non-spouse heirs federal estate tax free...

The U.S. Federal Estate Tax Unified Credit (the "Credit"), which allowed individuals to leave up to $13,990,000 to their non-spouse heirs federal estate tax free, was set to expire on December 31, 2025. At that time, the law called for the Credit to drop to approximately $7,000,000 per person.The estate tax aligns with the lifetime gift tax exemption, meaning that the amount an individual or couple may give, estate tax free when they die, is reduced by the amount of taxable gifts given during life.New York is one of only twelve states that currently assesses an estate tax (along with Connecticut, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, Oregon, Rhode Island, Vermont and Washington, and the District of Columbia).Complicating matters more is New York's "cliff effect." In 2025, a New York State taxable estate of $7,160,000 pays no estate tax. A New York State taxable estate of $7,200,000 pays $108,291 in estate tax. A mere $40,000 of assets over the New York credit results in paying $108,291 in New York tax!

Examples: "Trade Relations", "Export Controls" · Examples: hr5, h.r.5, sjres8, sa2, pl116-21, 86Stat1326

Estate tax rules change in 2025. Learn how shifting exemptions and planning tools impact family wealth transfer.

Most people do not think about taxes when the subject of death comes up, although the government always does. Estate tax enters the picture when property changes hands, and it rarely plays out in the way families imagine. In 2025 the rules shift again, and more households will be forced to do the tax math.In reality, the system is built with layers. Some families never owe a dollar, while others discover that even property they did not think of as taxable gets pulled into the total. In 2025 the estate tax limit is just under fourteen million dollars for one person.Anything above that figure faces a forty percent federal tax. It sounds like a number that only the wealthiest families need to worry about, and for now that is often true. The issue is that the current law does not lock this ceiling in place. At the end of 2025 it falls back to roughly six or seven million a person, once inflation adjustments are made. Families looking years ahead need to factor in that drop, because today’s wider margin may not last. The estate calculation is broader than many realize.Families sometimes expect that a trust or beneficiary designation removes the asset entirely, only to find it still included for tax purposes. Life insurance offers a clear example. If the deceased owned the policy at death, the full payout value gets added to the estate.

If you leave behind assets when you die, your estate may owe taxes. But the exemption amount in 2025 is so large that most U.S. taxpayers don't have to worry.

But only if the estate’s value surpasses a certain threshold, or exemption amount, will it be subject to the estate tax, sometimes called the “death tax.” The tax rate for estates currently ranges from 18 to 40 percent, depending on how much of the estate exceeds the exemption amount.That exemption amount is $13.99 million per individual in 2025 (this amount is adjusted each year for inflation). Only the amount of your estate beyond the exemption is subject to tax, so the estate tax currently applies only to ultra-high-value estates.Learn more: Trump’s temporary tax breaks: 5 ‘big beautiful bill’ provisions that may not stick around for long · The estate tax is a tax on the value of a person’s assets at the time of their death, applied before anything is passed on to heirs.According to the IRS, the gross estate includes all assets the deceased owned or controlled, such as: ... The taxable estate is what’s left after subtracting debts, funeral costs and charity donations.

The second installment of Cook County property taxes should have been paid Aug. 1. The county can’t get the calculations completed, so the bills are on hold.

Cook County residents were supposed to pay their second property tax installments on Aug.But repeated mistakes have flawed the system to the point that taxpayers could not expect to get correct bills were they mailed at present.The county finds itself unable to perform the basic function of tax collection, leaving taxpayers in limbo.The Cook County treasurer’s website features a banner indicating tax amounts have not been finalized and bills have not been mailed out.

California has no estate tax, but federal estate tax applies. Learn how to protect your wealth with careful planning.

Most high-net-worth Californians wrongly assume that their real estate portfolio is protected from crushing estate taxes just because California has no state-level estate tax. The truth? Federal estate tax still applies aggressively, and legislative whispers suggest California could revive estate taxes in the future.If your real estate assets push your net worth above $20 million, and you haven’t updated your estate plan for 2025, you’re at risk of losing millions to taxes instead of passing wealth to the next generation.California estate tax does not exist in 2025, but high-value estates face the 40% federal estate tax on amounts above the $13.61 million (per individual) exemption. Real estate heavy portfolios are vulnerable to steep tax hits if not shielded by advanced planning.And if the exemption sunsets to $7 million per person (as scheduled for 2026), their exposed amount skyrockets: $28M – $14M = $14M × 40% = $5.6 million in taxes. Faulty assumption: “California has no estate tax, so I’m safe.” This is a dangerous myth for any HNW investor.

Estate tax is a federal tax on the transfer of property at death. It is imposed on the decedent’s entire taxable estate before distribution to heirs.

The federal estate tax is closely coordinated with the federal gift tax to prevent avoidance through lifetime transfers. Both taxes apply at the same rates and share a unified exemption amount. The estate tax is codified in 26 U.S.C. § 2001, and the gift tax in 26 U.S.C.For 2025, the federal estate and gift tax exemption is $13.99 million per individual (or $27.98 million for married couples), with a maximum tax rate of 40%. Under the One Big Beautiful Bill Act, signed on July 4, 2025, the exemption will permanently increase to $15 million per individual beginning in 2026, indexed annually for inflation.Estate tax is a federal tax on the transfer of property at death. It is imposed on the decedent’s entire taxable estate before distribution to heirs.Many states also impose their own estate or inheritance taxes, with exemption amounts and rates that differ from the federal system.

Find common gift and estate tax questions, including when these taxes apply and when they do not.

Find some of the more common questions dealing with gift tax issues as well as some examples of how different types of gifts are treated. Learn when to file estate and gift taxes, where to send your returns, and get contact information if you need help.The estate tax is a tax on your right to transfer property at your death.Find some of the more common questions dealing with basic estate tax issues.Stay up to date with the tax law changes related to estate and gift taxes.

From April 2027, unused pension pots will be brought into inheritance tax rules, meaning many more families could be affected. With inheritance tax charged at 40% above the existing thresholds, some savers have already started gifting money to reduce the size of their estates.

From April 2027, leftover private pensions will be included in inheritance tax calculations. Estates above £325,000, or £500,000 if a home is left to children or grandchildren, face a 40% tax rate.Annual gifting allowances and the seven-year rule can reduce the size of an estate. Keeping records of gifts and planning ahead are essential to minimise future tax bills.From April 2027, a major change to inheritance tax rules will affect how pension pots are treated when you die. At the moment, most unused private pensions can be passed on tax-free, but soon they will be counted as part of your estate for inheritance tax.Currently, if you have a discretionary private pension (the most common type), and you die before using it all, the remaining money can usually be passed to your beneficiaries tax-free. From 2027, its value will be added to your estate when calculating inheritance tax.

The federal estate tax is a tax on property (cash, real estate, stock, or other assets) transferred from deceased persons to their heirs. Only the wealthiest estates pay the tax because it is...

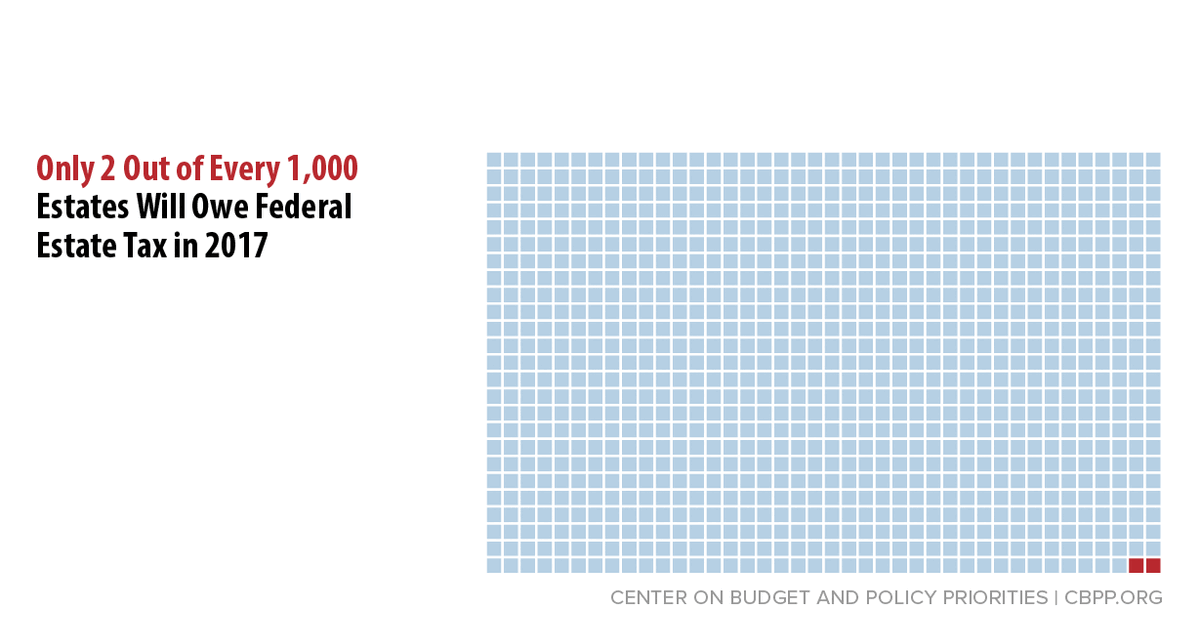

Only the wealthiest estates pay the tax because it is levied only on the portion of an estate’s value that exceeds a specified exemption level — $5.49 million per person (effectively $10.98 million per married couple) in 2017.[2]The estate tax limits the large tax breaks that extremely wealthy households get on their wealth as it grows, which can otherwise go untaxed.Today, 99.8 percent of estates owe no estate tax at all, according to the Joint Committee on Taxation.[4] Only the estates of the wealthiest 0.2 percent of Americans — roughly 2 out of every 1,000 people who die — owe any estate tax.As New York University School of Law professor Lily L. Batchelder explains, “it would be more accurate to call wealth transfer taxes [such as the estate tax] ‘silver spoon’ taxes, not ‘death’ taxes as their opponents prefer.”[5]Among the few estates nationwide that owe any estate tax in 2017, the effective tax rate — that is, the share of the estate’s value paid in taxes — is less than 17 percent, on average, according to the Tax Policy Center (TPC).[6] That is far below the top statutory rate of 40 percent.

The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death (Refer to Form 706 PDF). The fair market value of these items is used, not necessarily what you paid for them or what ...

The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death (Refer to Form 706 PDF). The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them.Once you have accounted for the Gross Estate, certain deductions (and in special circumstances, reductions to value) are allowed in arriving at your "Taxable Estate." These deductions may include mortgages and other debts, estate administration expenses, property that passes to surviving spouses and qualified charities.The value of some operating business interests or farms may be reduced for estates that qualify. After the net amount is computed, the value of lifetime taxable gifts (beginning with gifts made in 1977) is added to this number and the tax is computed.The tax is then reduced by the available unified credit. Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or elections, or jointly held property) do not require the filing of an estate tax return.

Only 4,000 estate tax returns were filed in 2023 showing an estate tax due, according to the Tax Policy Center.

When you consider that the Census Bureau estimates that about 2.8 million people died in 2022 (with estate tax returns due nine months later), you can see the estates of the vast majority of decedents are not taxable.Every time a new tax bill passes increasing the estate tax exemption, I’m met with comments like, “Will you be out of a job since no one has to worry about estate taxes anymore?” And yet, here I am, 35-plus years later, still doing estate planning for clients.Also, it’s a good idea to review your estate plan every few years and make changes as needed. Life changes faster than estate tax laws change. Estate Taxes don’t affect most people. But death and incapacity are still concerns for everyone. Get your plan in place, and maybe you can casually drop into conversations that you’ve had your estate plan created.But estate taxes were one of the myriad items covered by the Reconciliation Act signed into law on July 4, 2025, and unofficially referred to as One Big Beautiful Bill.

Kevin Mannix, a Republican lawmaker from Salem, would like to see voters repeal the estate tax.

State Rep. Kevin Mannix says he wants to kill Oregon’s so-called death tax. Mannix, a Republican lawmaker from Salem, would like to see voters repeal the estate tax.Mannix is the chief petitioner of Initiative 51 , the “End The Death Tax Act, and is gathering signatures to take the issue to voters in 2026. The Salem politician is no stranger to successful ballot measures. He’s the chief architect behind Oregon’s Measure 11, the mandatory minimum sentencing requirements passed in 1994. He was first elected to the statehouse in the late 1980s as a Democrat, but later became a Republican. He tried in 2012 to gradually phase-out the state’s estate tax but voters rejected the initiative.Oregon is one of 12 states that taxes people’s estates after they die. The estate tax kicks in for any estate worth more than $1 million, making Oregon’s tax threshold one of the lowest in the nation. It’s also fixed, so the amount doesn’t adjust for inflation.Oregon’s tax rate is also higher than most states. An estate worth more than $1 or $1.5 million can be taxed up to 10%. The federal government also taxes estates but has a $13.9 million exemption per individual.

By: Atty. Aziza Hannah A. Bacay on August 28,2025 Estate Tax, in general As a rule, the rights of heirs or successors to inherit are transmitted from the moment of death of the decedent. However, this transmission of rights is also subject to compliance with administrative guidelines and also ...

By: Atty. Aziza Hannah A. Bacay on August 28,2025 Estate Tax, in general As a rule, the rights of heirs or successors to inherit are transmitted from the moment of death of the decedent. However, this transmission of rights is also subject to compliance with administrative guidelines and also payment of appropriate taxes, fees, and […]Under the National Internal Revenue Code (Tax Code), estate tax at the rate of 6% is levied, assessed, collected and paid upon the transfer of the net estate of every decedent, whether resident or nonresident of the Philippines.The Bureau of Internal Revenue (BIR), for its part, argued that the exemption under RA No. 6426 is not listed among the allowable deductions from gross estate under the Tax Code. The BIR took the position that RA No.It is a well-established rule that, in interpreting laws, special law prevails over general law because it reveals the true intent of the legislature. A special law (like RA No. 6426) cannot be modified by a subsequent general law (like the Tax Code). Thus, the Supreme Court finally ruled that FCDUs are exempt from estate taxes.

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those ...

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts.Some opponents have called it the "death tax" while some supporters have called it the "Paris Hilton tax". There are many exceptions and exemptions that reduce the number of estates with tax liability: in 2021, only 2,584 estates paid a positive federal estate tax.If an asset is left to a spouse or a federally recognized charity, the tax usually does not apply. In addition, a maximum amount, varying year by year, can be given by an individual, before and/or upon their death, without incurring federal gift or estate taxes: $5,340,000 for estates of persons dying in 2014 and 2015, $5,450,000 (effectively $10.90 million per married couple, assuming the deceased spouse did not leave assets to the surviving spouse) for estates of persons dying in 2016.Because of these exemptions, it is estimated that only the largest 0.2% of estates in the U.S. will pay the tax. For 2017, the exemption increased to $5.49 million. In 2018, the exemption doubled to $11.18 million per taxpayer due to the Tax Cuts and Jobs Act of 2017.Many American states have repealed the rule against perpetuities, raising concerns that the combination of tax incentives and new legal rights encourages the devotion of vast wealth to perpetual trusts designed to benefit distant generations, avoid taxes, and maintain a degree of control over the financial affairs of descendants in perpetuity. One of the major concerns that motivate estate planning is the potential burden of federal taxes, which apply both to gifts during lifetime and to transfers at death.