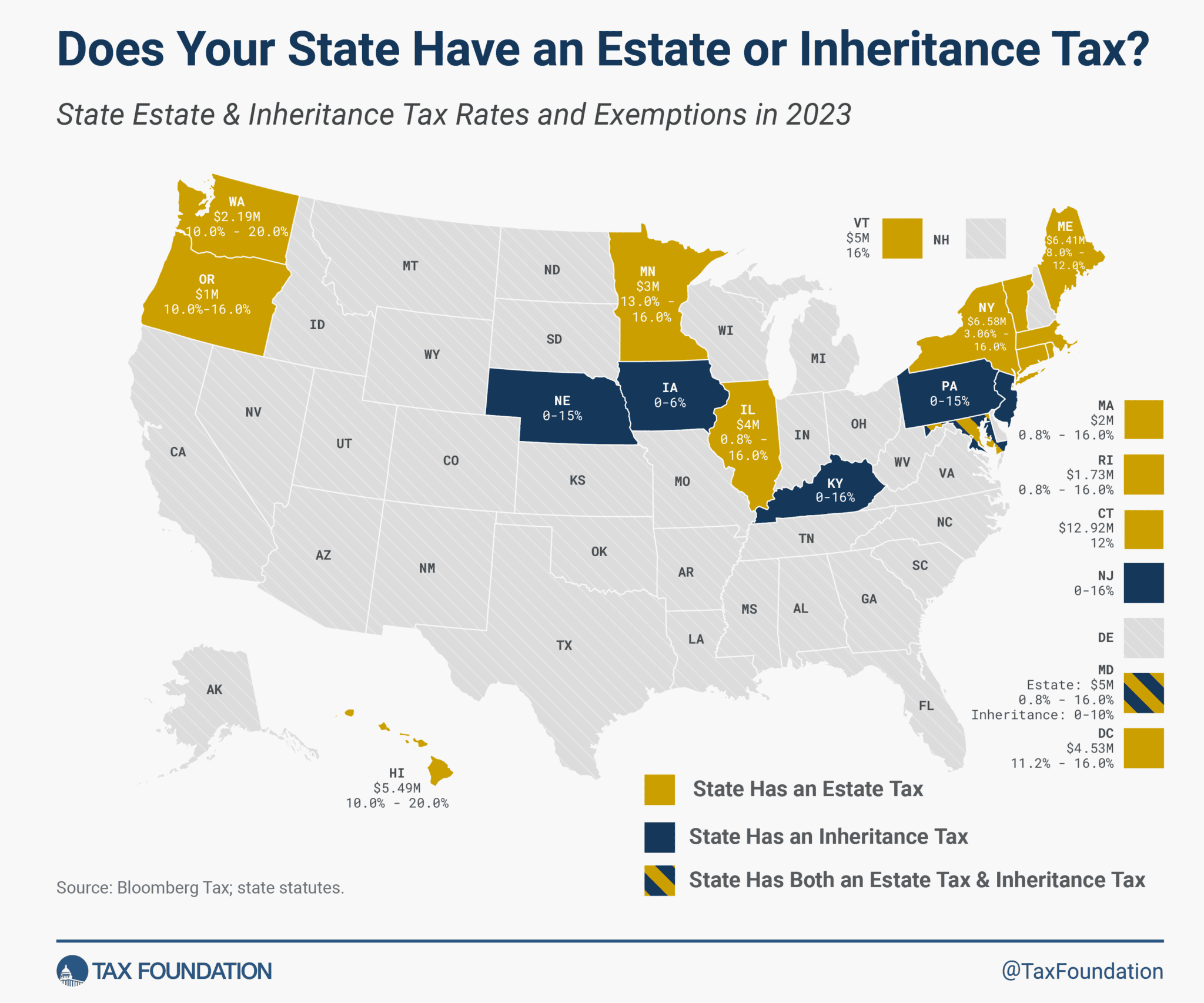

10 States with the Highest Estate Tax Rates in 2025

1. Washington State - Maximum rate of 20% on estates over $2.193 million, generating significant revenue for state programs.

2. Oregon - Progressive rates from 0.8% to 16% on estates exceeding $1 million, affecting many middle-class families.

3. Minnesota - Rates up to 16% on estates over $3 million, with additional gift tax implications for residents.

4. Rhode Island - Maximum 16% rate on estates above $1.733 million, one of the lower exemption thresholds nationally.

5. Connecticut - Rates from 7.2% to 12% on estates over $12.92 million, recently aligned with federal exemptions.

6. Hawaii - Progressive rates up to 20% on estates exceeding $5.49 million, affecting many property-rich residents.

7. Illinois - Flat 16% rate on estates over $4 million, with no deduction for state estate taxes paid.

8. Maine - Rates from 8% to 12% on estates above $6.41 million, with portability provisions for married couples.

9. Massachusetts - Progressive rates up to 16% on estates over $2 million, affecting many Boston-area residents.

10. New York - Rates from 3.06% to 16% on estates exceeding $6.58 million, with cliff provisions that can dramatically increase taxes.